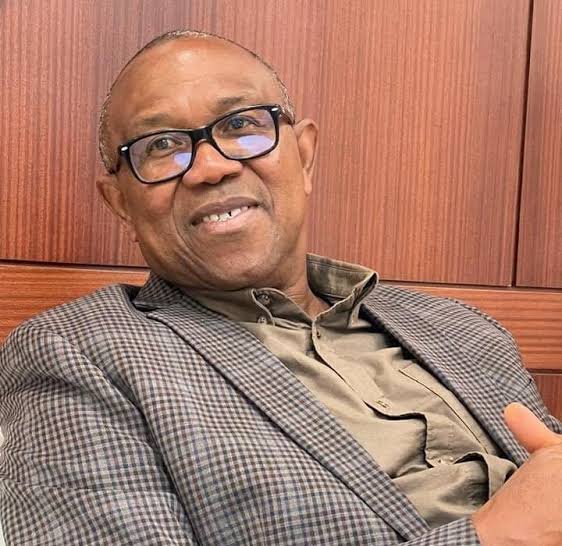

Labour Party’s 2023 presidential candidate, Peter Obi, has sharply criticised recent comments by World Trade Organization (WTO) Director-General, Ngozi Okonjo-Iweala, on Nigeria’s economy. She had praised President Bola Tinubu’s administration, claiming its reforms were “moving in the right direction” and had helped stabilise the nation’s finances.

Okonjo-Iweala made the statement on Thursday after a courtesy visit to the State House in Abuja. Her remarks came as the government continues to promote its economic agenda both at home and abroad.

However, Obi insisted that current figures tell a different story. He argued that the economy remains fragile, with foreign investment in steep decline.

FDI Figures Paint a Troubling Picture

In a post on X, Obi referenced National Bureau of Statistics (NBS) data showing a 70% drop in Foreign Direct Investment (FDI) during the first quarter of 2025.

The report revealed that FDI fell to $126.29 million in Q1 2025, compared to $421.8 million in the last quarter of 2024. According to Obi, such a dramatic fall undermines claims of economic stability.

Weak Capital Inflows to Key Sectors

Obi further explained that out of $5.64 billion in total capital inflows for Q1 2025, FDI accounted for only 2.24%, down from 8.2% in Q4 2024.

Moreover, about 90% of inflows were directed to short-term speculative money market instruments. These, he stressed, offer little benefit to manufacturing, job creation, or sustainable growth. In addition, capital inflows to the manufacturing sector fell by 32.1% during the same period.

Nigeria Trails in Africa’s FDI Rankings

When compared to other African countries, Nigeria’s position appeared even weaker. Africa attracted $97 billion in FDI in 2024, marking a 75% increase over the previous year.

Egypt led the continent with $46.58 billion in FDI, while Nigeria managed just $1.08 billion — a 42% drop from 2023. As a result, the country captured only 1% of Africa’s total investment inflows.

Call for Policy Reform and Investor Confidence

Obi maintained that such figures highlight deeper structural and governance problems. “With poor governance indicators and weak leadership, no amount of foreign trips or investment summits will secure sustainable capital,” he warned.

Therefore, he urged the government to prioritise investor confidence through policy stability, transparency, and a clear industrial growth strategy. In his view, only a shift toward productive investments can deliver long-term stability and prosperity.